Business lending fintech Avanseo has announced that it has raised €10m from French investment fund Newfund. The brand, which focuses on Very Small Enterprises (VSEs), will develop the first closing of its debt fund. Thanks to a 100% digital platform, a financing request can be made in a few minutes, processed in a few hours and the loan can be received within 24 hours.

Avanseo, a solution to optimize the process of professional loans

Founded in 2017 by Amine Hebri, the start-up Avanseo, based in La Défense, offers a solution to finance the cash flow needs of VSEs with the help of rapidly delivered credit. In 2021, there will be 3.7 million VSEs in France. The founder explains the situation of VSEs at the moment:

“Approximately 3 out of 4 VSEs are not equipped with operating financing or cash flow credit, despite the introduction of state-guaranteed loans a year ago. However, cash flow credit represents more than half of their financing needs. It is estimated that this unmet need amounts to 20 billion euros per year.”

In order to optimise the business lending experience and offer a suitable solution to VSEs that would find it difficult to apply for more traditional credit due to lack of time or resources, the fintech is offering a digital platform that aims to get rid of banking complexities. The brand promises a firm response within two hours and a transfer of the requested funds within 24 hours subject to a positive response.

Avanseo’s digital platform leverages machine learning to operate

Avanseo’s platform uses a machine learning model: nearly 10,000 data points per loan application were exploited to train the system. The use of this data was possible thanks to the second European Payment Services Directive (PSD2), a data sharing that became mandatory for banks since 2018. Amine Hebri refers to AI in his remarks:

“Artificial intelligence is at the heart of Avanseo’s technology. Using all the data available, AI allows us to process more information, eliminating certain biases, and draw more relevant conclusions. This minimizes both case processing time and decision errors.”

Here’s how the tool works: the MSE will fill out a form while connecting its accounts to the platform. This process only takes a few minutes. Two hours later, after analyzing the data, Avanseo offers a credit simulation whose interest rate varies according to the size of the company, the duration of the loan, the amount desired, the perceived risk or its activity.

Very small businesses can borrow between 3,000 and 50,000 euros. Repayment can be spread over 3 to 12 months at interest rates ranging from 4% to 15%.

A fundraising to increase the number of loans to very small businesses

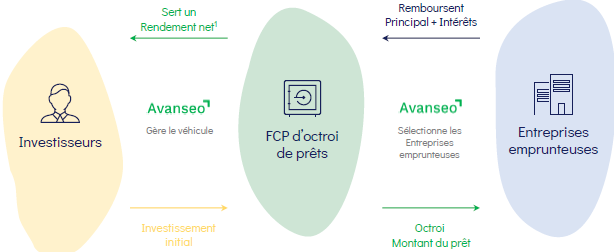

Thanks to this €10 million investment, the brand hopes to launch the first closing of its fund dedicated to financing the cash flow of very small businesses. Entitled TPE Tréso1, this fund aims to close at €20 million, which will be redistributed to businesses in the form of loans. Augustin Sayer, Partner at Newfund, Avanseo’s investment fund partner, spoke about the start-up’s ambitions and its advantages:

“Avanseo is responding to a more than ever obvious need – cash flow financing for VSEs – with a truly innovative solution based on open banking and a proprietary algorithm whose advantages are clearly perceived by the customer benefiting from a simple and fast process. The founder’s experience in banking and the company’s AMF approval also give Avanseo a head start. Newfund is happy to help this young company to continue its development and to become the benchmark for VSE lending.”

With a two-year life, the fund has an annual IRR target of over 8%. Over the next few months, the start-up hopes to increase the number of loans, improve its sponsorship strategy and build loyalty among its customers, three quarters of whom do not hesitate to take out a loan again.

Translated from Avanseo lève 10 millions d’euros afin d’aider les TPE à obtenir plus facilement des prêts professionnels