TLDR : The semi-annual Observatory by Numeum forecasts a slowdown in the growth of the digital market in France, with a decline in the sectors of digital services and technology consulting. Software publishers and cloud platforms remain resilient due to cloud migration. However, the adoption of generative AI is hindered by a lack of skills and challenges in identifying high-value use cases.

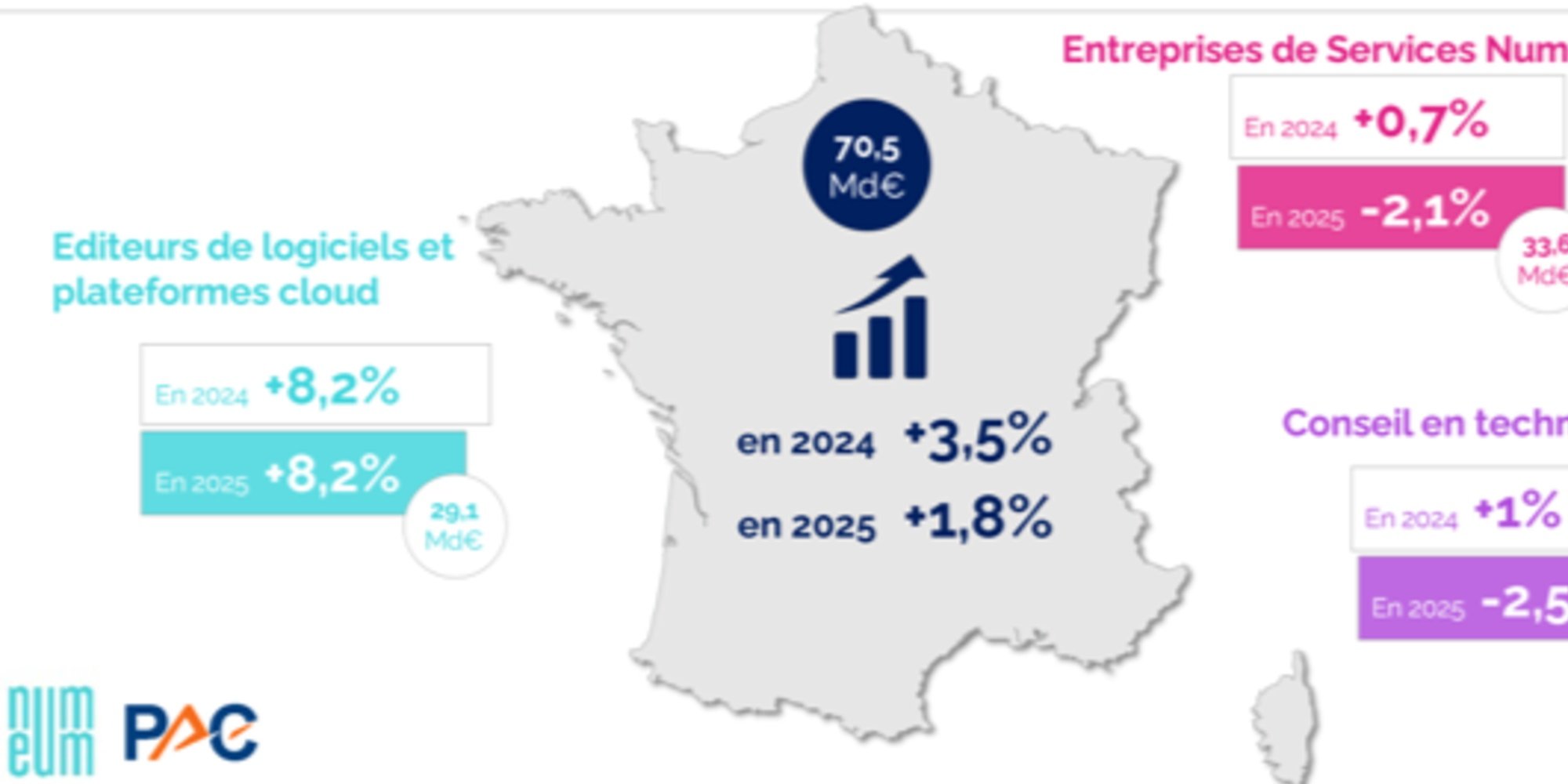

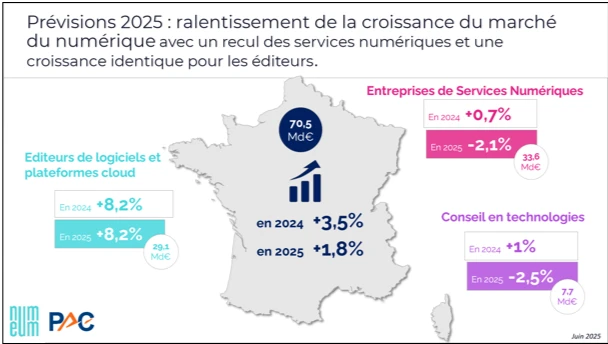

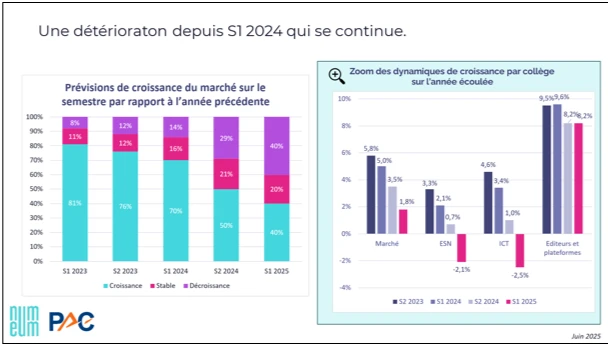

According to the latest semi-annual Observatory by Numeum, the leading union of digital companies in France, market growth is expected to cap at +1.8% in 2025, well below the +4.1% recorded at the end of 2024. This marked slowdown particularly affects IT services companies and technology consulting, amid an economic climate that is not conducive to investments. Only software publishers and cloud platforms are holding strong, showing a growth of +8.2%, driven by the migration to cloud (IaaS and PaaS) and pricing adjustments. However, this momentum is less about the emergence of structuring projects and more about already initiated technological inertia, with a limited trickle-down effect on IT services and technology consulting.

For the first time, these two historically driving segments of the sector are expected to decline: -2.1% for IT services and -2.5% for consulting, with a significant drop in team occupancy rates.

Generative AI: Confirmed Potential, Slowed Adoption

The most notable evolution may lie in the perception of GenAI. Nearly half of the companies surveyed (48%) now report working on projects related to this technology, compared to 29% at the end of 2023. Yet, this enthusiasm is not translating into massive investment. Two main obstacles prevail: lack of skills (47%) and difficulty in identifying high-value use cases (47% as well).

Uncertain Employment Prospects

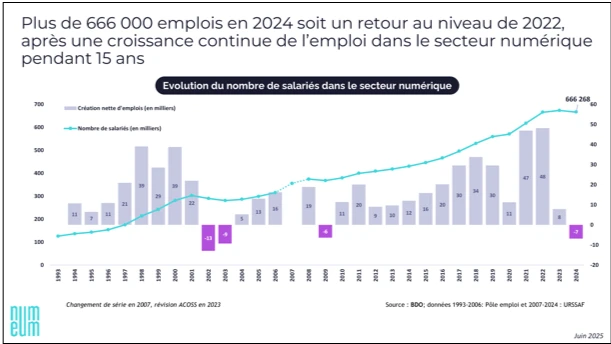

On the

employment front, the sector is returning to 2022 levels with around 666,000 positions. After a decline in 2024, recruitment prospects are darkening, especially for recent graduates and apprentices, with 36% of companies anticipating a decrease in offers for these categories.

Call for Collective Responsibility

Numeum warns of the risk of

France lagging behind, as the digital sector accounts for only 5.5% of GDP, compared to 10% in the United States, and ranks 22nd in

Europe in terms of digital use in companies. The organization advocates for maintaining fiscal incentives for innovation and calls on public authorities and companies to invest massively in digital transition:

"We call for the responsibility of political leaders to ensure an investment-friendly climate by not questioning support mechanisms for innovation (Research Tax Credit, Innovation Tax Credit, Young Innovative Company, tax depreciation for innovative SMEs); and we also call on leaders of different economic sectors to ensure investments for the benefit of the French and European economy (developing European digital autonomy in technology and skills)."

"Digital technology is the oracle of our competitiveness. It is urgent to reverse the trend as France risks seriously falling behind in international competition."

To better understand

What is the Research Tax Credit (CIR) and how does it work in France?

The Research Tax Credit (CIR) is a tax incentive in France allowing companies to receive a tax reduction based on expenses incurred for research and development activities. It aims to encourage investment in innovation, covering costs like researcher salaries, research equipment, and intellectual property expenses.

Why is France lagging behind the US in terms of the percentage of GDP linked to digital?

France's lag behind the US in terms of the percentage of GDP linked to digital can be attributed to several factors, including historically lower investments in the tech sector, slower adoption of digital technologies in French businesses, and a smaller digital market size. Additionally, public policies in Europe may offer less direct support or be more regulated compared to the US, where the tech sector is more dynamic.